Income Protection

Your most valuable income earning asset is yourself. What would happen if you got sick?

There are a number of options and combinations to consider when it comes to protecting your income and covering unexpected costs if accident or sickness strikes. What you choose will depend on what’s best for you and your family, which is why it’s important to speak directly with a specialist adviser, who will work with you to tailor something that suits your individual needs. Builtin partners with the experts at Insurance People to ensure our customers get the best possible advice and solutions.

Income Protection/Loss of Earnings

ACC only covers accidental injury, not illness. Income protection insurance covers you if you can’t work due to illness or accident. It will provide payments in addition to ACC or for events that are not covered by ACC. Taking income protection insurance in combination with ACC Cover Plus Extra can substantially broaden your cover for a similar cost to your ACC-only levies. If gives you:

- Certainty of premiums for the year ahead

- Huge increase in cover without the huge increase in cost (by using the same money to cover more risks)

ACC Dial Down

If you’re self-employed or running a small business it’s likely that your income fluctuates from year to year. Payouts from ACC are based on 80% of your income for the previous 12 months, so a bad year could adversely affect the amount of compensation you receive. Your accountant may also split your income with your partner for tax purposes, and this can affect the income ACC will use to calculate any payments. With ACC Cover Plus Extra you can agree a fixed income with ACC, so your payout and the levy you pay are guaranteed.

This must be done alongside income protection insurance.

The Statistics

out of every 100 Kiwi men between ages 30 & 65 will have at least 6 months off work through disability

out of every 100 people off work through disability will have an illness rather than injury

Claim Example

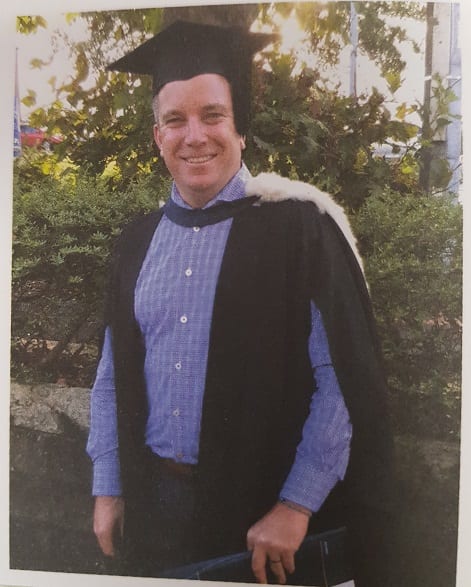

Reece's story...

Reece was a fit, healthy young guy with a busy life and a young family. He had an active, physical job as a builder and was a keen sportsman – a yachtsman, cyclist and runner who had recently completed his first marathon. At 38, life was good.

In September 2014, what started out as a normal work day on site at Paremoremo soon changed when Reece collapsed and fell from the 2nd rung of his ladder. Find out what happened to Reece…