Articles, Guides, Checklists and Videos

Articles

Have you protected what’s most important to you?

5 things to get sorted before you go on holiday

Are builders responsible for the insurance excess in the building contract?

How insurance helped Reece after he collapsed on site

How insurance can protect builders if they breach environmental laws

10 year guarantees – what are the benefits for homeowners & builders?

Does insurance cover gradual damage?

What happens to your income if you get sick? ACC won’t cut it.

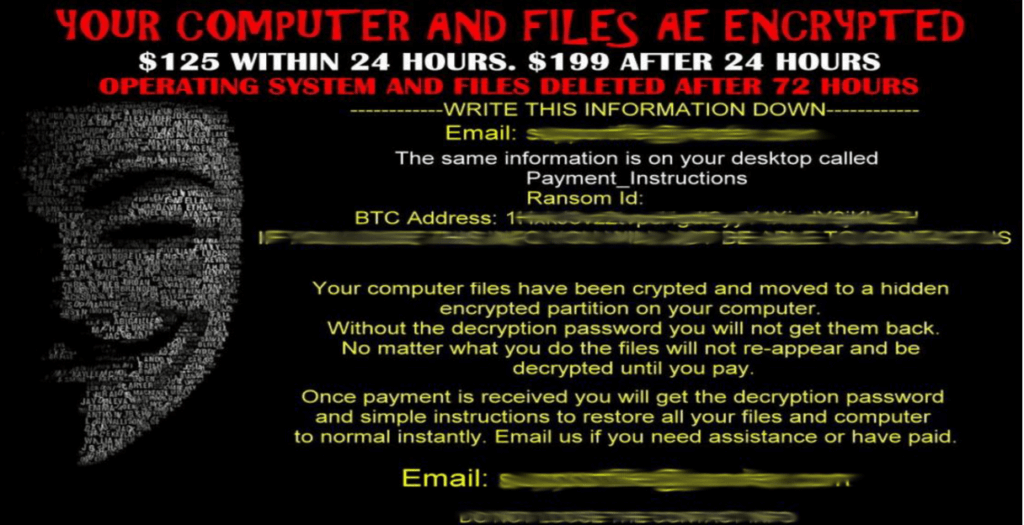

Cyber attacks are becoming a genuine threat to Kiwi trade businesses

Videos

Guides & Checklists

Simple Risk Management Checklist

Use the checklist below to lower the odds of some of the most common risks faced by construction companies and tradies happening to you and your projects.

Key Risk Checklist for Builders

Work through the checklist to see how well you’re managing the top 5 risks identified by builders. It’s recommended to use the checklist for every job or project.

Construction Project Risk Checklist

Use this form for each new job or project. It will help ensure you have covered off the most important tasks to mitigate risk to the project’s success.

Easy Guide to Contract Works insurance

Builtin’s Guide to Contract Works Insurance outlines some of the most important issues with this type of cover that builders need to be aware of when starting a new project.

Defective Workmanship Cover Explained

Defective workmanship—by you or your team—can expose you to thousands in liability, legal fees, and damages. Make sure you’re properly protected.

Basic Tool Inventory for Builders

Use this table to work out how much your tools are worth and keep a record of them. You can save and update the list any time. You will be able to print a copy.

Best Practice Payment Schedule Calculator

Create clear, fair payment schedules in line with the Construction Contracts Act. Avoid disputes, and break down large project costs into staged payments.

Quick Insurance Review for Contractors

Insurance Checklist For Builders, Trade Professionals, and Construction Companies.. Use this checklist to make sure you have the cover you need.

Construction Project Insurance Checklist

Every building project involves risk. The risk may be higher or lower, depending on a whole range of factors, and you will need to eliminate, isolate or minimise these risks.