by Ben Rickard | Mar 8, 2024 | Insurance, Risk Management

Three companies working in the construction sector have been sentenced for two separate incidents that each resulted in the tragic death of a young worker. In the first incident, a 21-year-old was killed when the steel beam he was removing fell and killed him on a...

by Ben Rickard | Jan 17, 2024 | Insurance

A liability policy pays for the loss that someone else has suffered but that you’re responsible for. With public liability (also known as general or broadform liability) this generally equates to the value of the property that has been damaged. If that property...

by Ben Rickard | Jan 7, 2024 | Insurance

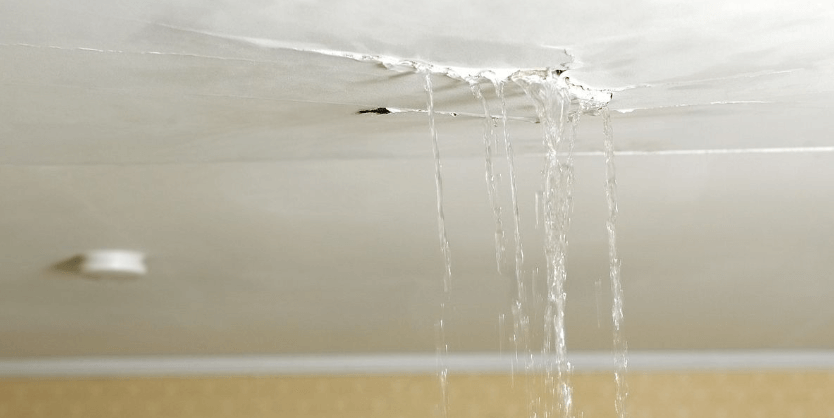

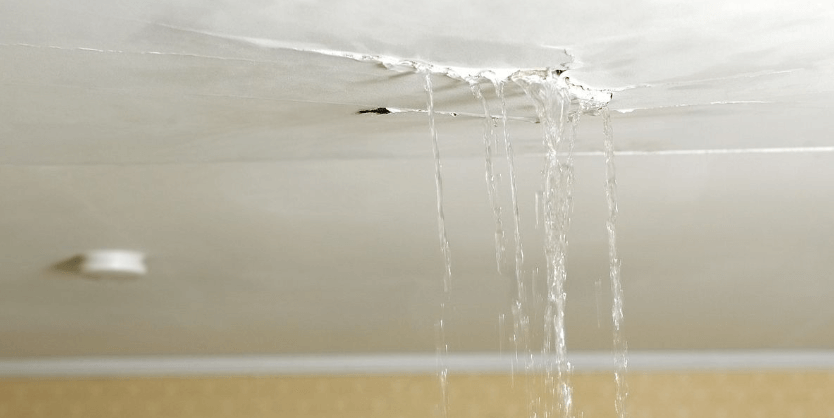

It’s not uncommon for accidental damage to potentially be covered under both contract works and liability insurance. Generally, this comes up when a sub-contractor has caused damage to other parts of the work in progress. For example, where the plumber hasn’t fitted...

by Ben Rickard | Nov 7, 2023 | Insurance

Insurers have different approaches to the way they cover issues of faulty workmanship. This is particularly relevant for contractors who commonly work on or around other people’s property. Which cover is the right one depends on the type of work you’re doing. It is...

by Ben Rickard | Sep 5, 2023 | Insurance, Other, Risk Management

Managing risk as a landscaper is about more than just having the right insurance. Physical injury and the proper handling of chemicals, such as fertilisers and sprays must be managed, for example by having good training and procedures in place. The same applies when...

by Ben Rickard | Sep 1, 2023 | Insurance

Ben Rickard, Construction Expert at Builtin Insurance Brokers, summarises the key questions that arose during ITM’s recent LBP Training Days. What is the Building Defects Exclusion? This is a clause added to all public liability policies (and others) after the leaky...