The latest data from the BRANZ showed that liquidations in the construction sector rose 37 percent in February year on year, accounting for 31 percent of all liquidations nationwide. And according to MBIE data, the number of construction businesses that had a liquidator appointed by the end of June 2025 was 687, representing a threefold increase in just three years.

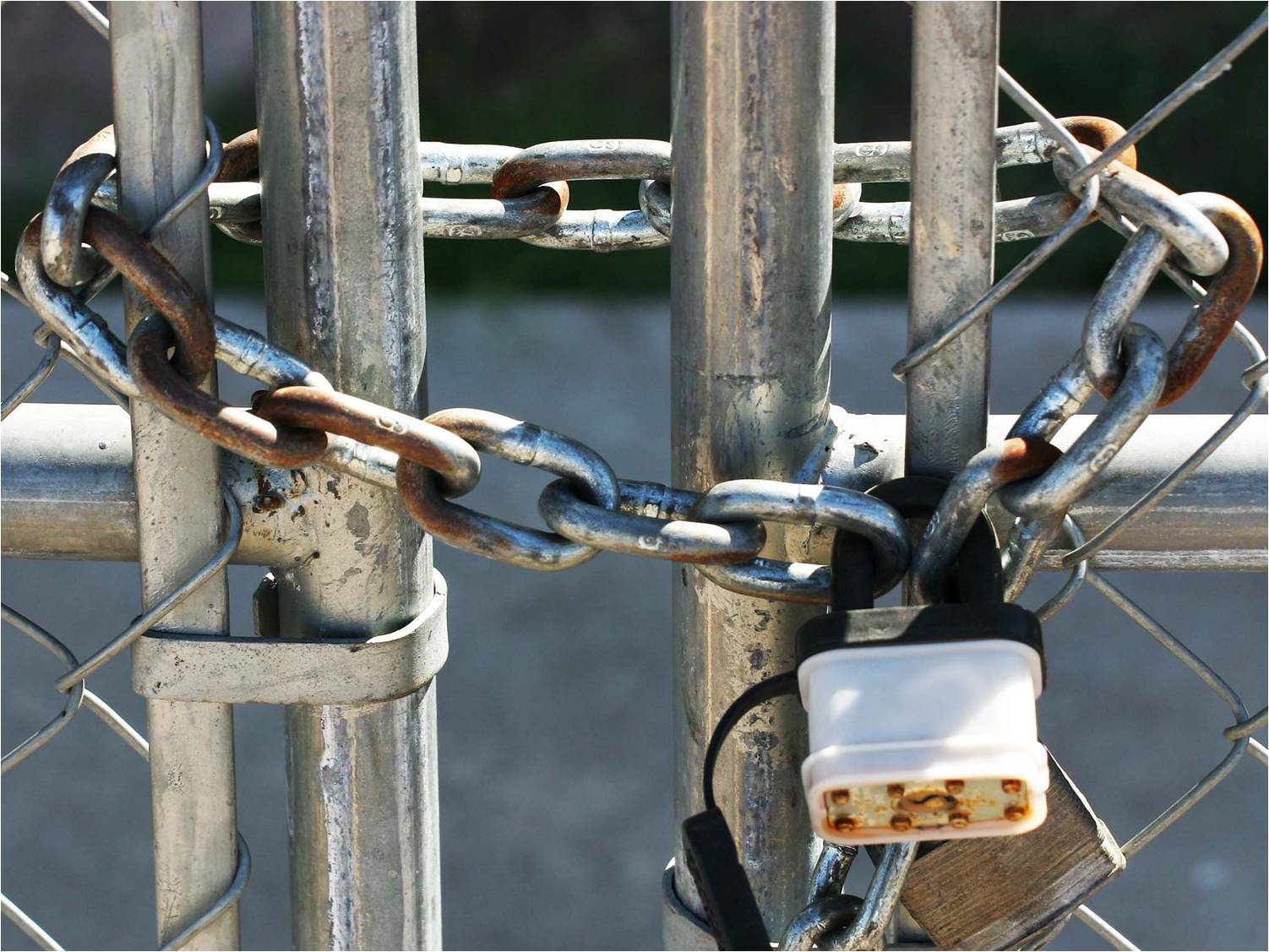

If you’re working for one of these companies when it goes bust the effect on your own business, workers and family can be hugely challenging. It can set off a chain reaction of collapses, as subcontractors themselves fold under the financial pressure of not getting paid.

So, what can you do to mitigate this risk?

Step One

The first step, which might seem obvious but often gets overlooked, is to know your counterparty (that’s the contractor you’re going to be working for). We suggest checking the following:

- How long as the company been registered?

- Has it been set up recently or just for this project and has no real assets?

- Are financial statements available??

- Who are the directors & shareholders and have any of them had issues in the past?

Much of this can be found on the Companies Register (https://companies-register.companiesoffice.govt.nz).

Also check online, social media and other independent and informal enquiries with industry stakeholders.

Consider how the contract and payment terms are structured to minimise your potential loss if something happens.

Think about demanding a bond in lieu of retentions and/or construction payment bond to ensure you’ll get paid for your work if the main contractor fails to do so.

Step Two

Once the project has started ongoing monitoring is essential. If you can catch something early you’re much more likely to limit potential losses. Below are what’s known as the Plymin Factors, which are key indicators of corporate insolvency. Depending on the size of your counterparty, some of this information may be more accessible than others:

Factors indicating corporate insolvency:

- Ongoing trading losses

- Liquidity ratio below one

- Overdue tax obligations

- Poor banking relationships or inability to secure funding

- Lack of new finance or equity

- Restricted credit terms with suppliers, such as cash on delivery only

- Overdue payments

- Irregular payments not linked to specific payment claims

- Legal action or creditor demands against the company

- Inability to provide timely and reliable information, such as reporting on retentions held on trust for subcontractors

Perhaps as importantly, keep your ear to the ground among other subcontractors and creditors. If you hear a murmur about issues that’s the time to act.

Step Three

If you suspect that your counterparty might be in difficulty there are some precautionary steps you can take to limit your losses:

- Ensure communication and note taking does not jeopardise any future recovery or legal action

- Take immediate professional advice

- Review your financial exposure to the project and consider ways to restructure it

- Think about what assets of yours are at risk if the site is closed down by a liquidator

Conclusion

The impact of not getting paid can have huge consequences for a small construction business. With insolvency risk rising, being proactive and diligently monitoring your counterparties is essential. Wishful thinking or putting your head in the sand are not sound strategies, swift action could make all the difference.