This is a question we’re getting on an almost daily basis. And it’s because more and more builders are coming to appreciate the full scope of their liability. This is the result of two things:

- building owners are becoming more difficult and more likely to demand compensation if they’re not satisfied with the work that’s been done (or to get out of paying in the first place)

- the range of legal remedies available to dissatisfied homeowners has grown with various amendments to the Building Act over the past few years

Because of these changes, the core package of liability insurance a builder should carry has also grown. Plain old public liability insurance is no longer enough. Your package now needs to include cover that is common in other industries, and even among other construction professionals such as engineers and architects, but is only now being more widely adopted by builders.

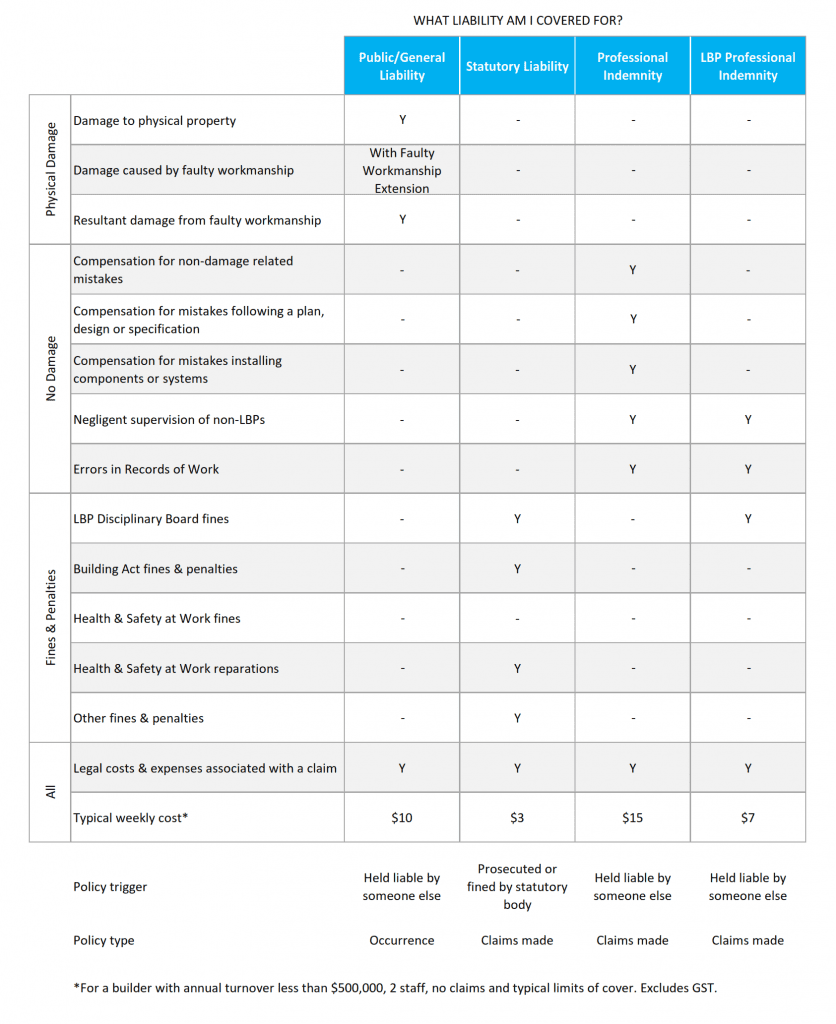

Below is a table showing the broad strokes of the cover available under the four most common liability policies.

At Builtin we think a package that includes the first three offers the most suitable cover for the broader risk profile now faced by builders.

LBP Professional Indemnity, while tempting because of its lower premium, offers a much narrower cover than full professional indemnity insurance, which covers the big exposures builders are most likely face.

Here’s three examples where professional indemnity insurance applies:

Slab laid too close to boundary – $40k

A surveyor was engaged by the builder to mark out a site. Unfortunately,the surveyor stuffed up and as a result the foundations were laid too close to the boundary. The cost of fixing this error came to $40,000, which the builder was held liable for. As the surveyor’s terms and conditions stated that they could only be liable for a maximum of 2 x their fee, the builder was forced to pay most of the cost from their own pocket.

Q. Is it a public liability claim?

A. No, because there is no physical damage to the property, which would be a requirement under public liability insurance.

Q. Is it a Professional Indemnity claim?

A. Yes, because someone the builder is responsible for has made a mistake that has caused financial loss to the client.

Council inspections not arranged – $20k

A builder was contracted to perform earthquake remediation, a reclad and re-roof to a Christchurch home. The builder failed to arrange all the inspections required and the Council subsequently refused to grant a CCC. An independent assessment required both cladding and roof material to be removed as part of the inspection, and multiple failings were identified that the builder was held liable for. The cost of the inspection and remediation work in order to obtain a CCC amounted to over $20,000.

Q. Is it a public liability claim?

A. No, because there is no physical damage to the property, which would be a requirement under public liability insurance.

Q. Is it a Professional Indemnity claim?

A. Yes, because the builder’s mistake in failing to arrange the inspections led to the client’s financial losses.

Joinery incorrectly measured – $75k

A builder in Auckland subcontracted the installation of joinery.Unfortunately, the subcontractor didn’t measure it correctly or follow the manufacturer’s installation guide. This was picked up shortly after the CCC was issued and in the subsequent legal action involving the Council, the builder and subcontractor, the builder was found significantly responsible and ordered to pay a large share of the overall damages, in addition to his hefty legal bill.

Q. Is it a public liability claim?

A. No, because installing something wrong is not considered to be physical damage to the property, which is the test under public liability insurance.

Q. Is it a Professional Indemnity claim?

A. Yes, because the subcontractor, who the builder engaged and was responsible for, made a mistake that caused financial loss to the client (the cost of replacing and re-installing the joinery).

The solid foundation to a builder’s risk management plan

In a nutshell

It’ll come as no surprise to note that you’re more likely to be held liable for a mistake than ever before, with more rules to follow and more people willing to have a go at you. This means upping your game when it comes to managing this risk. Having the right liability insurance package to suit your business is a good start.

Note: the examples and descriptions of cover given here are a guide only. Whether a particular event is covered will depend on the specific circumstances and wording of the policy.