It’s not uncommon for accidental damage to potentially be covered under both contract works and liability insurance. Generally, this comes up when a sub-contractor has caused damage to other parts of the work in progress.

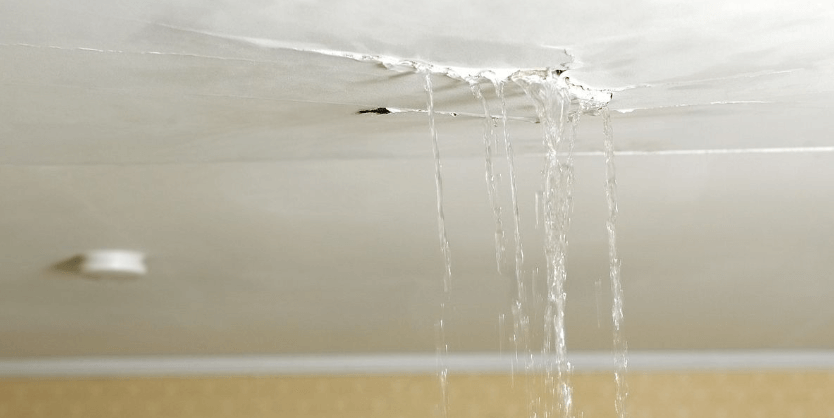

For example, where the plumber hasn’t fitted the hot water cylinder correctly in a new build and it leaks. In this case a claim could be lodged under the contract works insurance, which would cover the repair costs. However, main contractors and homeowners are often reluctant to make claims on the contract works (or house) policy if someone else has clearly caused the damage. Instead, they would hold the plumber liable for the damage they’ve caused, which the plumber could claim under their liability insurance.

The generally accepted, and preferred, practice is for the claim to be made under the primary policy (the one insuring the building/contract works itself). This would pay to repair the damage and the insurer would then look to recover their costs (and the customer’s excess) if they can identify someone responsible for the damage. In the case of contract works, subbies are generally also noted as insured parties on the policy, so the insurer would not be able to recover from them. But the subbie would be expected to cover the excess (and this is often written into the contract).

An increasing number of liability insurers now expressly exclude claims if there is a contract works insurance policy in place that would cover the damage. As a subbie, if the contract works policy includes sub-contractors as insured parties (which most will) you’re entitled to be covered by it, it’s just that the main contractor usually holds the details of the policy and would lodge the claim.

In some cases, contract works insurance might not cover the damage, most commonly if it is for defective workmanship. Another example could be scratched glass, a common contract works exclusion. In that case a liability claim could be made, but this can be complicated as issues of care, custody or control and who owned the damaged items come into play.

In a nutshell

If you cause accidental damage to works under construction the policy to claim on is the contract works insurance, whether this is arranged by the main contractor or the homeowner. Even as a subbie you are entitled to claim under it. An increasing number of public liability policies won’t cover claims if there is contract works insurance in place that would do so. If a contract works claim fails you could look to your liability cover, but whether cover is available will depend on the specific circumstances.