The recent flood and cyclone events have resulted in tens of thousands of property insurance claims across the North Island. While insurers typically use a panel of approved builders the scale of these events make it likely that a range of approaches will be needed. If you are contacted by a home or business owner to quote for and/or remediate flood or storm damage here’s how you can ensure it’s a good experience and avoid any potential pitfalls.

Steps To Speed Up The Claim Process

Click here for guidance on what people should do and the information insurers need from home and business owners when making a claim. This includes links to Ando’s “Claim Guide”, IAG’s “Disaster Claims Hub” and EQC’s “What We Cover”.

IAG are now offering a self-serve option for customers who want to speed up the claim assessment process by engaging a qualified tradesperson to see what repairs are needed and obtain a repair quote. There are a is a form to complete if they would like to go ahead with it: https://engage.ubiquity.co.nz/forms/mf364jrbgjmny66l13fkm1l5f400jlrn602qpj27m1_0kmw4kdmf3dbhtnfj

There are a few key things to note:

- Customers will need to provide photos of the damage.

- A qualified tradesperson will need to provide them with a detailed written quote for the cost of repairs.

- The quote and photos must be emailed to [email protected], including the claim number in the subject line. For any costs already incurred, receipts are to be attached to the email.

- Once IAG receive the information, if they consider it to be fair and reasonable, they’ll talk to you about settling the claim by paying the estimated reasonable cost to repair the damage to the property.

Additional damage and further costs after settlement

- They’ll pay the estimated reasonable cost to repair the damage to customers’ properties.

- However, if a customer spends the settlement money on repairs and find they need to incur additional costs to complete the repairs, or if they find additional damage relating to the claimed event during the repair process which was not included in the agreed scope of the repair, talk to IAG.

- Customers may be able to ask for additional payments, subject to certain conditions.

Make Good/Make Safe

Insurers have pre-authorised the stripping out of wet carpets and underlay. The same applies to minor damage that could be fixed to make property safe and weathertight, including temporary repairs such as boarding up broken windows.

A priority will be ensuring the health and safety of homeowners and building users, including protection from the development of black mould and fine dust from dried silt. This work can be done before a loss adjuster has attended the property/claim approval.

Property should be thoroughly dried out before remediation work commences. If moisture is present when repairs begins it can result in poor finishes on repaired surfaces and lead to mould formation and deteriorating structural materials.

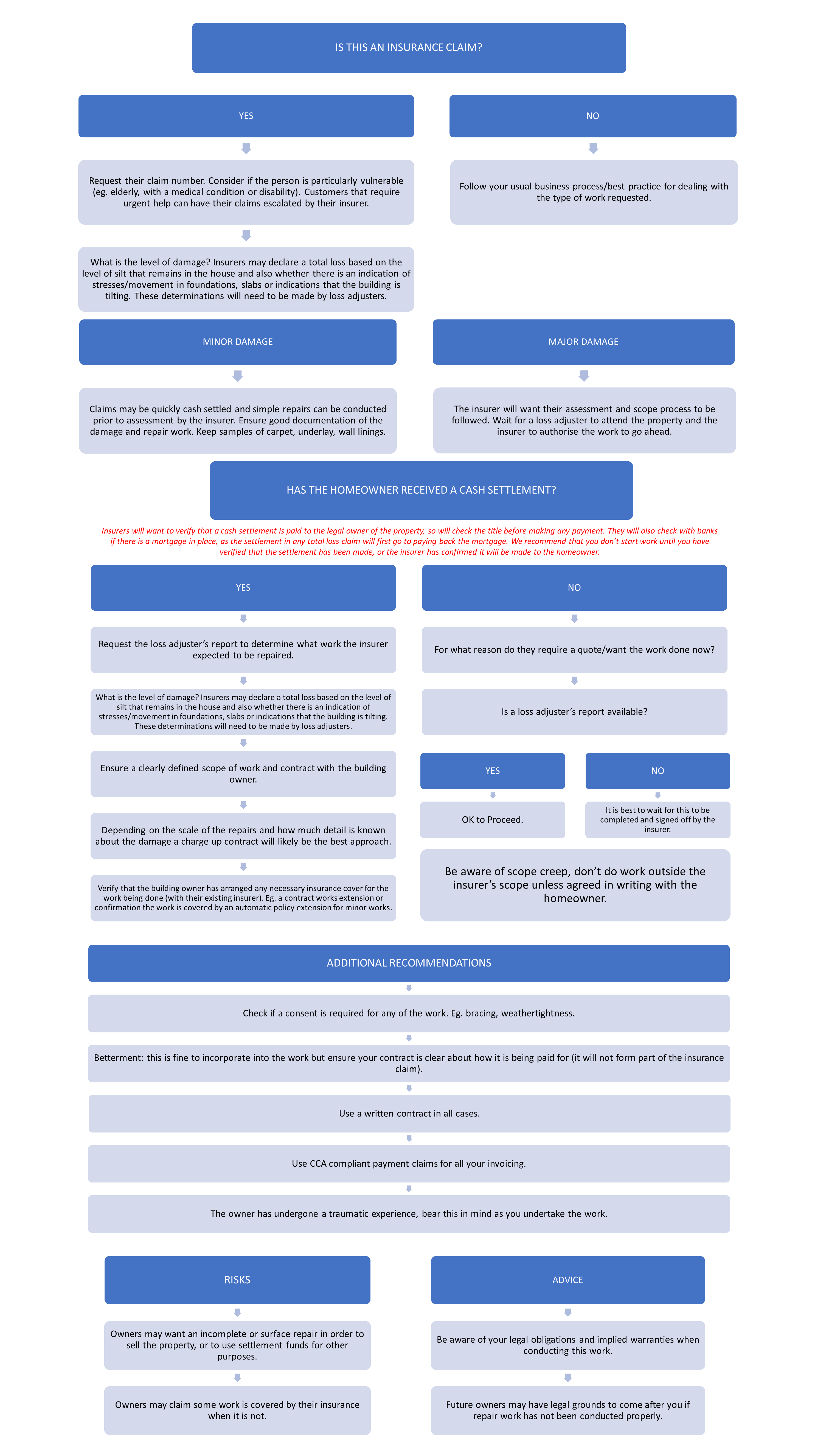

Flow Diagram & Advice

EQC Claims

Insurers assess and settle EQCover claims for building and land damage in accordance with The Earthquake Commission Act 1993, on behalf of the Earthquake Commission (EQC). That means they now manage any EQCover claim(s) with affected policyholders from end to end, including assessing the damage.

Additional Resources

Guide to Working On Flood Damaged Property (CHASNZ): https://www.chasnz.org/articles/auckland-flood-remediation-how-to-keep-healthy-and-safe-while-working-on-flood-damaged-property

Contract Guidance for Severe Weather Events (Construction Sector Accord): https://www.constructionaccord.nz/news/news-stories/contractual-guidance-due-to-severe-weather-and-flooding-events/

Extreme Weather Information for Businesses: https://www.business.govt.nz/risks-and-operations/extreme-weather-information-for-business/