Builtin speaks with thousands of builders and other LBPs up and down the country every year. And one message comes through loud and clear: you’re not doing enough to protect your income if something happens and you can’t work.

It’s estimated that 80 in every 100 of you have not optimised your ACC cover or put in place adequate protection in case of illness. And yet this is one of the most common risks to your ability to bring in an income. If you’re a self employed builder staying healthy is pretty important. Getting sick or injured can have a big impact on your ability to keep the money rolling in.

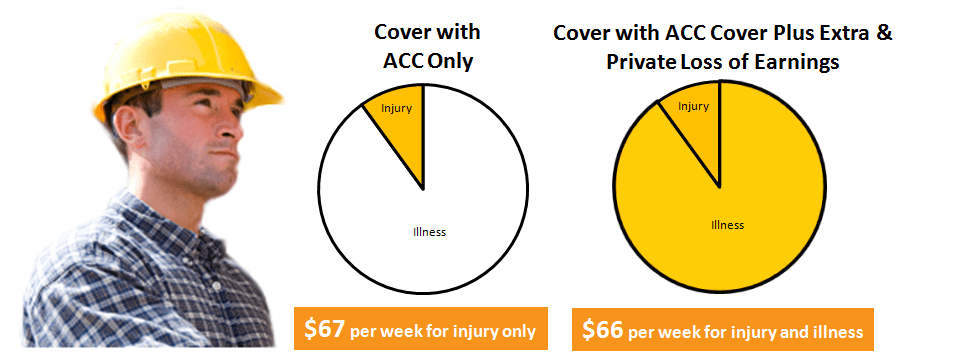

Out of every 1,000 builders off work through disability, 900 will be laid up due to illness not accident. And yet ACC only provides compensation for accidental injury, not illness.

“Not going to happen to me” I hear you saying? The same thing I thought for many years, until I hurt my back, had to have surgery and was off work for 6 weeks. It made me realise that I’m not invincible, I can get hurt or sick, and I began to consider the impact of this on my income and my family.

What’s the solution?

The recommended option for self-employed builders is to switch from the default ACC plan to something called Cover Plus Extra. There are a number of benefits to doing this, including:

- Saving money on the levies paid for administrative (non-building) staff

- Agreeing a set income level on which your compensation (and levy) is based

- Dialling down your levy payments and using the saving to broaden the cover you get

ACC levies for admin staff

If you’re on the default plan all staff, even those only doing admin, will be rated at your business ACC classification. Under Cover Plus Extra you can pay a cheaper rate for office-only staff, which could save you thousands.

Speed and certainty if a claim is necessary

On the default plan your compensation is capped at 80% of your actual income, which ACC will determine at the time of the claim by looking at your books. This process can take some time, during which you’re not getting compensation. If you’ve had a slow patch in the last 12 months or your accountant has split your income with your partner for tax purposes, you may find that your ACC payout is well below what you expect, and need. On Cover Plus Extra you agree a fixed income with ACC and get 100% of that figure if you have to make a claim.

Dialling down your ACC levy and broadening your cover by going private

Cover Plus Extra also allows you to dial down your ACC levy contributions to a minimum level. Savings can then be used to buy income protection insurance, which gives cover for both accident and sickness & illness. This substantially broadens your cover to include the events that are most likely to keep you off work.

A Typical Example

Consider Dave, a 40 year old builder earning $80k:

Dave’s ACC levy works out at around $67 per week for injury only cover. By reducing his ACC cover to the minimum allowable under Cover Plus Extra and taking out private loss of earnings insurance he ends up paying $66 per week for cover that includes both injury and illness. This is based on a 5 year benefit period vs cover under ACC that could run until retirement. However, as 91% of claimants are back to work within the first 5 years this makes sense. Alternatively, for cover that runs until age 65 the cost would be an extra $20 per week. There are also other considerations that may affect whether this arrangement is right for you, such as your age and any pre-existing conditions.

I’m an employee, can this help me?

While employees don’t pay their own ACC levies, you can still benefit from income protection insurance if you’re forced off the job through illness, which is not covered by ACC.

Even those who do have insurance often face long stand down periods before receiving any payout. For builders, a plan that includes specific injury benefits can offer the best cover.

What are Specific Injury Benefits?

Income protection policies all have a stand down period, which for many injuries can be longer than the time you’re off work. This means you may get nothing despite being unable to work for many weeks.

With specific injury benefit cover you’ll immediately receive a payout in the event of certain injuries, regardless of the stand down period in your policy. And it pays the benefit regardless of whether or not the injury keeps you away from work. That means you could fracture your wrist, return to work the following week and still receive a month’s worth of benefit.

What should I do?

If you haven’t done this yet, or want to review the cover you have, get in touch with your financial adviser, or contact Builtin. They’ll arrange for you to have a chat with an adviser, who is also a former builder, and put some options on the table. You can request a review at: https://builtininsurance.co.nz/builtinrecover.