Reece was a fit, healthy young guy with a busy life and a young family. He had an active, physical job as a builder and was a keen sportsman – a yachtsman, cyclist and runner who had recently completed his first marathon. At 38, life was good.

In September 2014, what started out as a normal work day on site at Paremoremo soon changed when Reece collapsed and fell from the 2nd rung of his ladder. His workmates rushed over, thinking he might have had an epileptic fit, only to find him unconscious. About 4 minutes passed with Reece slowly regaining consciousness, much to the relief of his workmates. An ambulance was dispatched despite Reece’s protests – he thought it unnecessary and was already contemplating a quick return to work.

Upon the arrival of the ambulance, the medics conducted their routine checks, assessing and quickly deciding on an urgent transfer to North Shore Hospital. The ambulance team warned Reece that a sizeable medical team would await his arrival. A team of 12, including a nurse Reece knew from his local rugby league club, greeted him. The nurse called to break the shocking news to Reece’s partner, Emma: Reece was in critical care at North Shore Hospital with a suspected heart attack.

Emma arrived scared and frightened. The long journey had begun. In the following days, the Specialist team caring for Reece eliminated a heart attack before diagnosing non-ischemic severe cardiomyopathy, or in layman’s terms, decreased heart function to the point of heart failure, likely caused by a virus attacking his heart. Unfortunately, this was not something which could be fixed with surgery and a handful of pills. After an initial period of stabilisation, Reece underwent the first of two surgeries to implant a pacemaker and defibrillator. A long, uncertain rehabilitation lay ahead.

In many ways, Reece could have considered himself unlucky. He was young and fit with no risk factors and no previous health issues, but he was struck down by a virus which attacked his heart

– a fairly rare event. Luck was with Reece in one way; however, not even 12 months prior to the fateful day, Reece’s financial adviser had recommended Reece and Emma review their insurances. He

suggested a comprehensive bundle of products including Life Cover, Trauma Cover, Total and Permanent Disability Cover (TPD), Mortgage Repayment Cover (MRC) and Premium Cover. Thankfully, Reece and Emma had followed his advice, and a potentially devastating financial blow was minimised.

The lump sum trauma payment was received, with his MRC payments commencing after the 8-week waiting period he had selected. His financial worries were taken care of, meaning Reece could focus on his recovery without the ongoing stress of financial uncertainty.

Over the next few months, Reece developed a close relationship with his medical team as he learned to monitor and manage his condition. Until this point, Reece had not returned to work. There came a day when he asked the question of his specialist: could he realistically expect to return to his trade, the only job he’d ever known? If Reece had worked in a less physical capacity the answer would have been easy, however it was not so black and white Even with a pacemaker and a defibrillator, there was a risk his heart, if pushed too hard, could stop and he could collapse – a risk to him and potentially his workmates. Reece’s TPD insurance provided coverage in the case that he was unable to return to his own occupation, and with this determination being made by his specialist, the lump sum TPD payment was made.

Regular MRC payments continued, but 12 months into his recovery, Reece began thinking about his future. He’d always loved his job. He enjoyed working. He needed to work. It gave him a sense of purpose in addition to much-needed social and mental stimulation. What did the future hold? After contemplation and research, Reece settled on a Bachelor of Business (Property and Valuation) with plans to become a valuer. Partners Life funded Reece’s university studies with the Vocational Retraining and Rehabilitation Benefit provided under his MRC insurance.

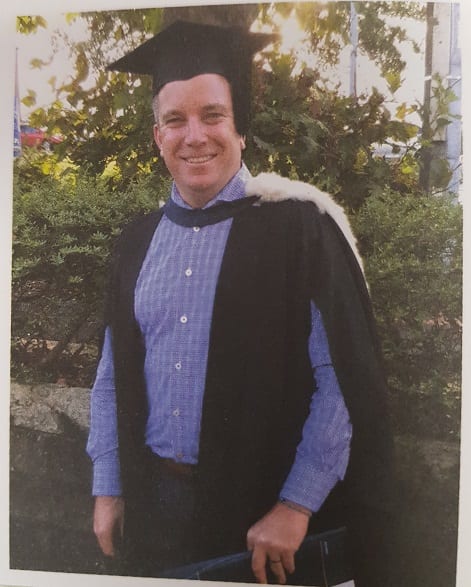

His health was stable, Reece graduated and returned to work in the middle of 2017. He is unequivocal about the impact his policy had. “Our Partners Life insurance gave us back some power, it provided us with choices and meant I could do what was best for me, my health and my family without having to worry about the financial implications. Along the way, all the decisions have been ours to make; we were never forced into anything by the situation we found ourselves in”.

“Whilst I would never have wished for this to happen, it could have been so much worse. We could have been ruined financially, with the pressures impacting our marriage and our futures. As it happens, we are in a strong position financially and we have a bright future to look forward to”.

A happy footnote. 2016: A leap year caught Reece by surprise. After 10 years, Emma proposed, and a wedding followed. In July 2017, they welcomed their 2nd son, after 7 years of trying.

This article was originally published by Partners Life, Partners Papers, Issue 12, November 2017.